In early December, the Vanguard ran a story, “Can Hotels Be the Short-Term Revenue Fix That the City Needs?” Citing projections from PKF Consulting, which was privately commissioned to do a study on the market demand analysis, it was believed that four new hotels could generate between $1.5 and $2 million in new revenue for the city just by themselves.

If these are accurate projections, the city may be able to solve at least some of its fiscal problems by developing its hotel market to secure more in Transient Occupancy Tax (TOT), which goes directly to the community with no tax-sharing requirements with other jurisdictions.

As Councilmember Brett Lee put it in an interview last month, why take the risks of developing 200 acres, “when I can go and the city council can approve a hotel on two acres and get $500,000 a year pretty much guaranteed?”

However, there is some skepticism about the numbers from PKF. Community Development Director Mike Webb told the Vanguard in December that the city has commissioned its own study of the market, due out in mid-to-late January, that they hope will give them a better picture.

In the staff report to the Planning Commission on Nishi, where one of the hotel proposals would be placed, staff notes, “Staff and the City Council have raised the question of the market’s ability to absorb all proposed hotel rooms, and are seeking to have a game plan for evaluation of the various proposals to maximize consistency with City Council goals to facilitate development of a hotel conference center, ensure fiscal resilience, develop a diverse economy, and improve downtown as a destination.”

Council has already approved a hotel conference facility on Richards and staff notes “entitlement applications were submitted for two extended-stay hotels: one on Cowell Boulevard in south Davis, and one on 2nd Street in Mace Ranch.”

The city has contracted with HVS Hotel Management Contract Survey, a hotel consulting firm, to evaluate the proposals and the potential for the Davis market to absorb new rooms. Staff reports that they are hoping to bring preliminary conclusions to the city council in February.

The PKF study puts the proposed Embassy Suites, which is currently on hold due to pending litigation, as critical to the analysis of other hotel needs. PKF argues that utilization of “even half of the 18,000 square feet of meeting space would likely require additional guestrooms than what would be offered at the Embassy Suites, thus requiring additional, conveniently located hotels to accommodate this overflow demand.”

“A hotel with approximately 18,000 square feet of meeting space would typically feature between 350 and 400 guestrooms,” they note. But the Embassy Suites will have just 132 rooms, which means that Davis will need other hotels to complement the Embassy Suites in order “to capture either overflow group demand that is booked at the Embassy Suites (but can’t be accommodated).”

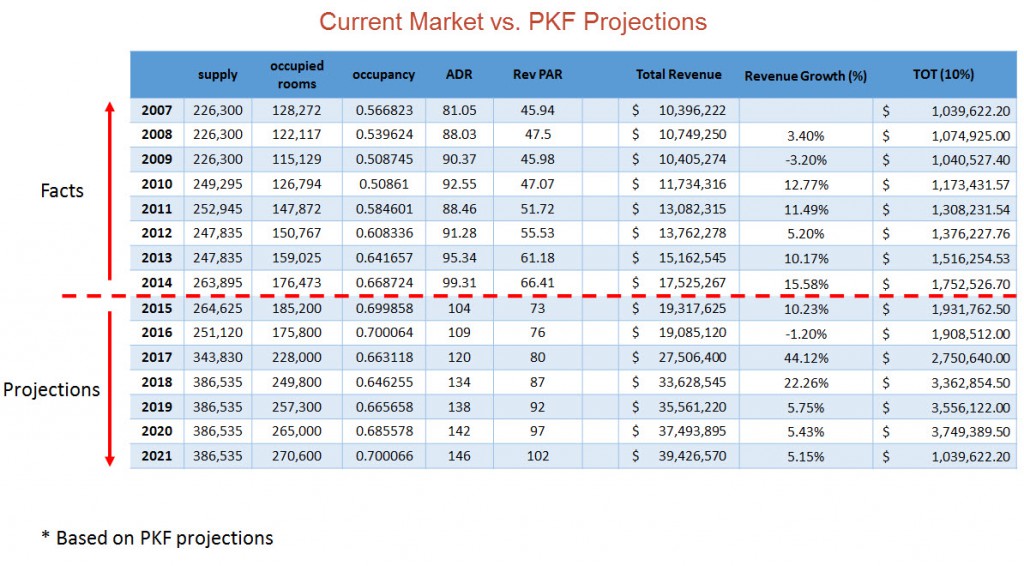

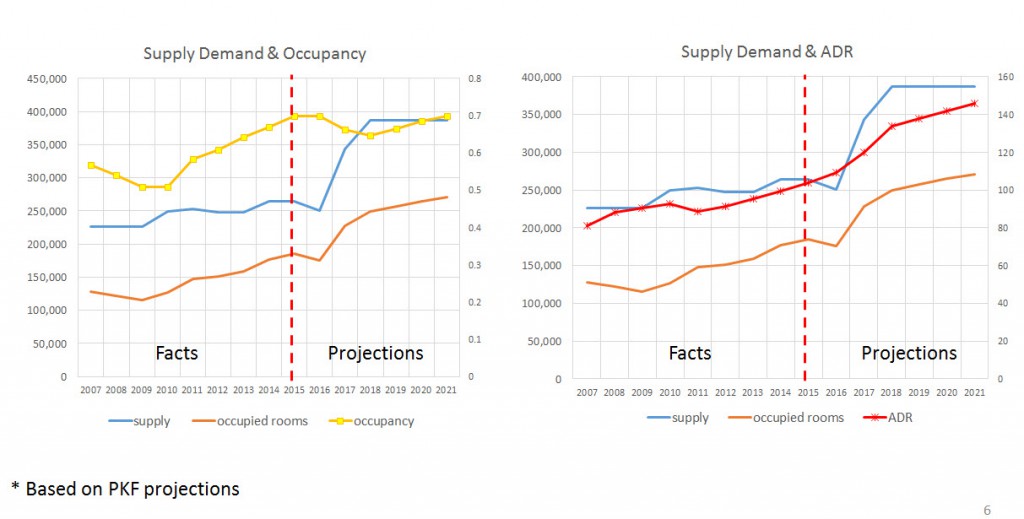

PKF argues that at least three new sites can be “readily absorbed by the market,” and they find “occupancy is projected to increase to 67.0 percent in 2019 and further increase to approximately 70.0 percent in 2020 and 2021. It is at this level we project the Davis hotel market to stabilize. While this stabilized occupancy level is above the annual average occupancy level achieved by the Davis hotel market since 2007, it is in line with the year-to-date performance and is reflective of the growth occurring in Davis.”

Existing hotel owners are skeptical of these claims from PKF and point to their own analysis that paints a very different picture.

They note, while the occupancy rate has increased from 61 percent in 2012 to 67 percent in 2014 (the most recent data available), the rate varies by day and month. Basically, from Sunday through Thursday, hotels have trouble booking rooms, and it is only on the weekends, mainly Friday and Saturday, where hotels approach 70 to 80 percent capacity.

But even these are variable depending on the time of the year, with the summer months generating heavy usage that falls way off during the late fall to early spring. In essence, there are only about five times during the year when the market is saturated – when UC Davis opens, Picnic Day, and during three separate graduations in the spring, fall, and for the law school.

The analysis notes that coupling additional hotels with the already-approved Embassy Suites would add about 328 rooms to the market that would have to be absorbed – the existing hotel owners do not see the demand generators at this time to justify that belief.

In addition to questioning the growth rate in occupancy, existing hotel owners question whether the ADR (average daily rate), which is currently at around $100 per night, will really increase nearly 50 percent in the next 7 years to $146 per night.

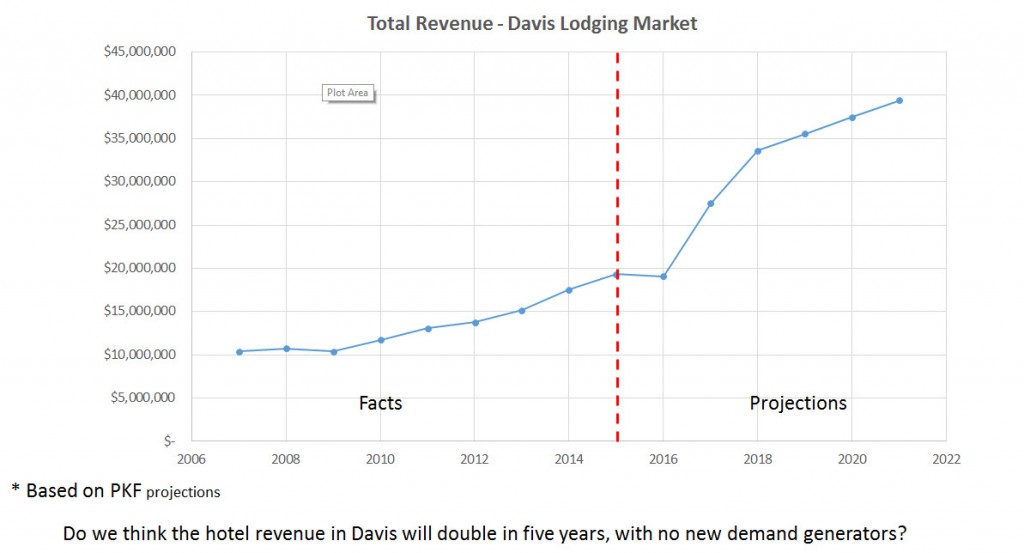

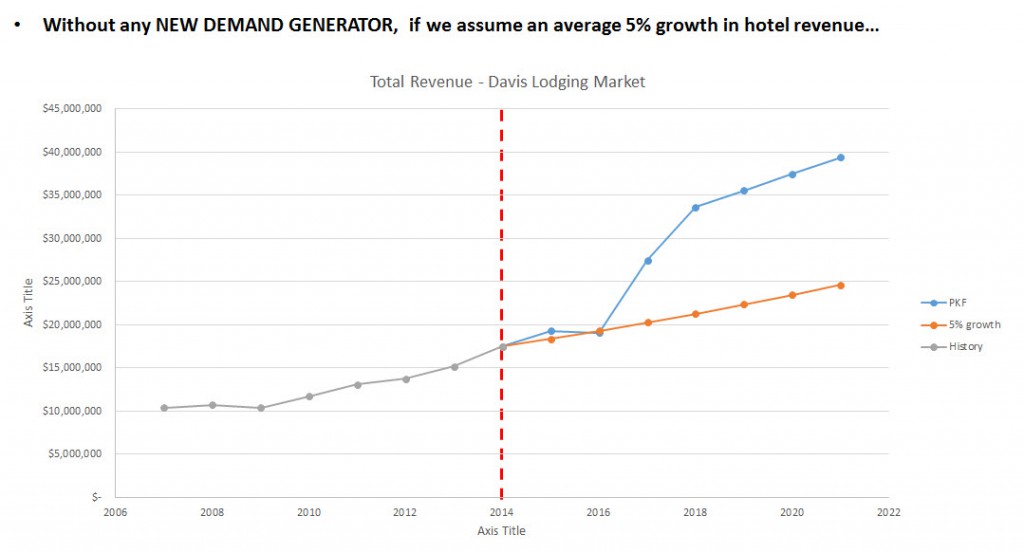

The current hotel owners argue that the key to understanding the PKF projections rests here. Over the last eight years or so, the market has peaked at the level in gray. The PKF model suggests an industry that would grow from roughly $17 million a year upwards to $40 million by 2021.

The chart shows what a more realistic assumption would look like. At 5 percent growth, which is keeping more with historic revenue growth, the hotel industry would move from just over $17 million up to $25 million by 2021. Even that growth rate, some say, is optimistic.

The premise of the PKF study is that there is leakage from Davis to surrounding cities like Woodland due to lack of supply. The statistics suggest otherwise, the hotel owners argue. Right now, Sunday through Wednesday is dead. If there are days of leakage, perhaps Friday and Saturday are those days, but, most of the time, those days are averaging at most 80 percent occupancy rates during peak months.

There are perhaps five days a year when there is leakage to other cities, but that is not sufficient to justify the proposed increase in rooms PKF is suggesting.

Woodland is building additional hotel capacity – about 240 new rooms. However, Woodland’s room generator is not Davis or UC Davis, but rather the Sacramento airport, where people traveling from the north will stop in Woodland and take a shuttle the next day to catch their flight.

In their experience, Davis’ overflow does not go to Woodland where they would have to take Hwy 113 or Road 102, but to Dixon which is on I-80.

The PKF analysis points to the Embassy Suites Hotel as the demand generator. There is skepticism there as well. For one thing, the hotel owners argue, there is probably enough existing capacity to accommodate the overflow of most conferences.

There are questions about how many conferences Davis would attract. Already the city has lost Bayer and Monsanto, which generated some hotel stays.

There are cases to be made that the innovation centers and UC Davis will draw more conferences, but those innovation centers may come with their own hotels anyway. If the conference center is to generate new demand, the existing hotel owners want to see that in action before new hotels get built.

The bottom line for them is that the PKF analysis was overly optimistic about the future of the hotel market and its ability to accommodate more supply. The city is commissioning the HVS study that they feel will have more modest projections and that give the community a better picture about the revenue potential for new hotels and what the city needs to do to generate its needed revenue.

—David M. Greenwald reporting

seems like the answer to that is because it’s not so simple.

I’d like to know how the Hyatt on campus is doing. Whenever I drive by, business appears slow.